Our people at Tankard Wealth are here to help you build a retirement plan that ensures stability throughout your life, preparing you for the unforeseen, the hurdles you might face and safeguarding your wealth in the most effective way possible. After a lifetime of work you are ready to enjoy your later years, and reap the rewards for a quality of life and enjoyment that you deserve.

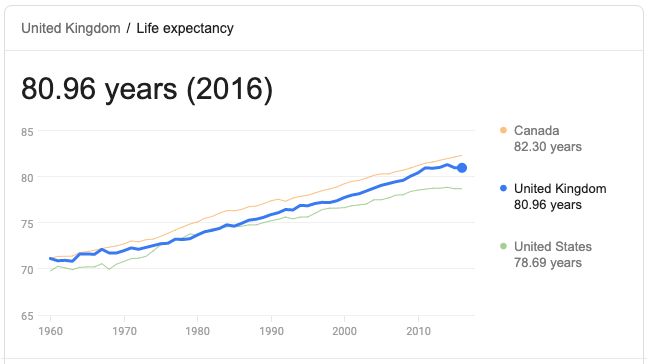

With the average life expectancy only set to increase further in the next few years, many individuals regrettably and unnecessarily find themselves struggling to cope financially in their latter years nowadays. Our fiduciary duty to our clients is to make sure they understand what pension options are available to them, and how saving for the future can also have tax perks for you today, and afford you the choice of lifestyle at retirement.

Your Investment Manager will guide you through the innumerable pension choices available at a time when selecting the correct option has never been so crucial. By reviewing your existing financial portfolio together with any shortfalls, we ensure a strategy that is designed with your priorities and circumstances in mind, whilst importantly allocating your wealth in a diversified and tax efficient approach. As part of our ongoing service to you, we ensure your portfolio is actively managed for optimal growth, and align your investment strategy to be in a position for when it is time to draw your benefits at retirement.

Our clients can be rest assured that Tankard Wealth considers the building phase, and the drawing phase to be equally important. As Investment Managers, our aim is to enable a smooth transition from the maintenance of your portfolio to the regular drawing of your income in retirement and beyond.

Your expert Investment Manager is here to help you every step of the way in your pension planning, and offers you trusted and impartial advice throughout your journey.

Any questions you may have will be answered and handled with care at initiation and throughout its entirety:

When should I start saving?

Am I contributing enough?

Should I join my employer’s scheme?

What will happen to my pension when I die?

How much income am I likely to receive?

What will be the consequences for delaying my savings?

Can I be more tax efficient and pay more in?

Can my business save more NI and Tax with a pension?

At Tankard Wealth, we understand every case is distinctive which is why you will sit down with your Investment Manager to discuss your personal circumstances and financial objectives. Based on this data, we will then compile a bespoke plan that is suitable and appropriate to your financial requirements. Your portfolio may hold a variety of features but typically when saving towards your pension it will include:

Self-Invested Pension Schemes (SIPPs and SSAS)

Personal Pension Plans

Stakeholder Pension for both Individuals and Corporations

Employee Benefits and Auto Enrolment for Businesses

Corporate Pension Schemes – Defined Contributions

Overseas Pensions (QROPs and QNUPs)

Whether you have existing pension arrangements or starting to save towards your retirement, your Investment Manager will carefully consider a number of factors including your Lifetime Allowance issues, any flexible retirement benefits and your lifetime cash flow forecasting. A comprehensive analysis is undertaken, looking at what pension provisions you already have in place and how to make the best use out of drawing those benefits when required, or indeed the provisions that will be need to be put in place for your future.

Utilising and Drawing Pension Benefits

With the recent overhaul in UK pensions, legislation stipulates that individuals have more freedom than ever before with their pension flexibility, however it is imperative that before any decisions are taken with drawing your benefits you consult independent advice. Choosing the right decision regarding your pension and retirement is one of the most important choices you will make during your lifetime, and our expert advisers are here to guide you in finding the most appropriate option. Our Investment Managers are available to answer any questions, whilst taking into consideration your circumstances and individual requirements in order to be certain that the course that is taken is the right one for you.

Do I buy an annuity or drawdown my pension?

What options are available for my spouse?

What will happen to my pension when I die?

What is a Pension Commencement Lump Sum and should I take it?

Tankard Wealth is an independent firm, meaning as Investment Managers we can foster our collaborative relationships with the top investment houses and throughout the market to select the right portfolio blend for a personalised solution, in order to meet your objectives. Our impartiality is a cornerstone feature of the Tankard Wealth service that offers access to a breadth of financial products.